PwC Truck Study 2022: zero-emission trucks are the most promising powertrain technologies

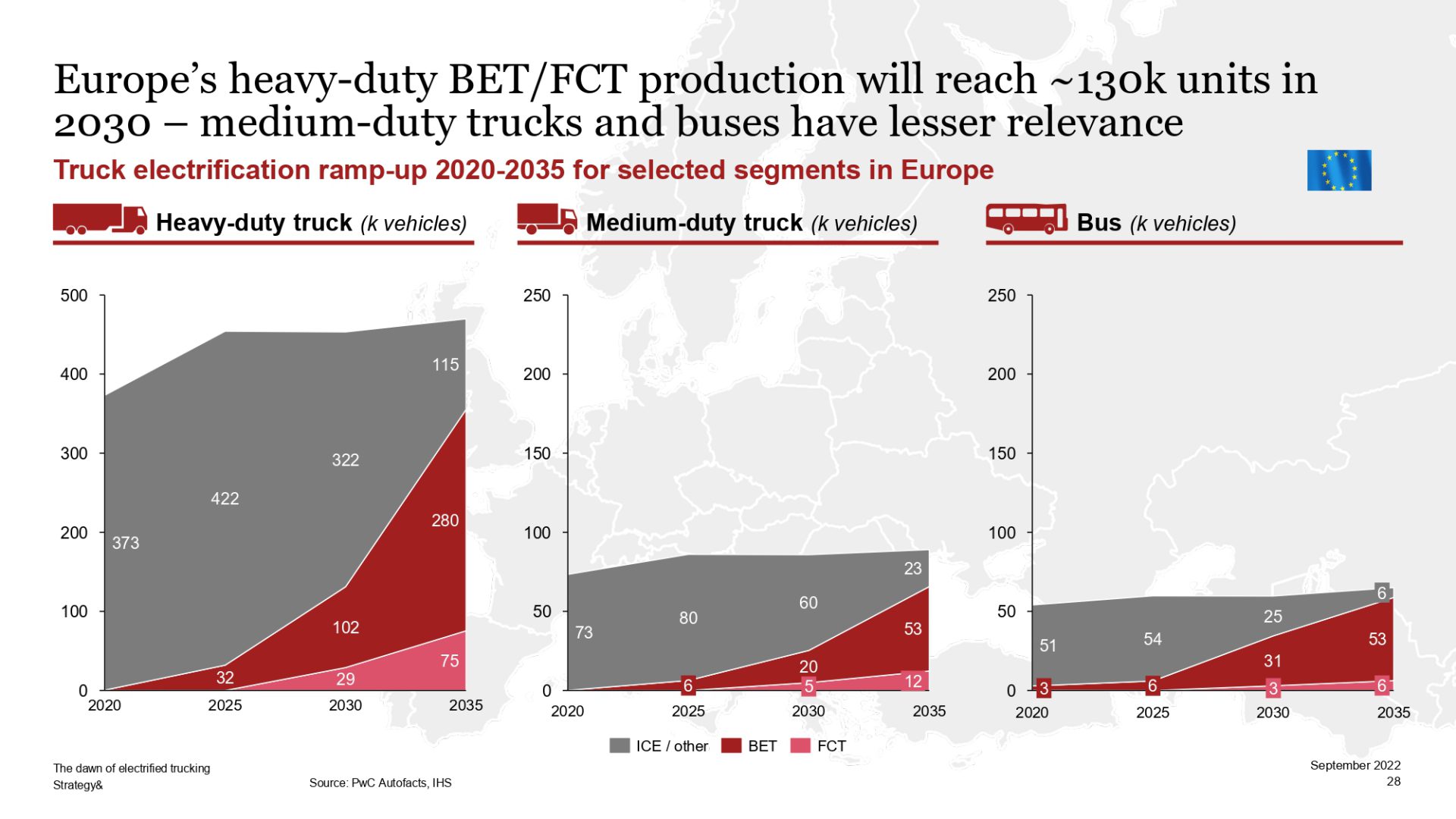

Both battery electric and fuel cell trucks are expected to account for 30% of the overall sales in 2030, with "dominance" in the main global areas (North America, the EU and Greater China) in 2035, accounting for 80% of the overall sales. Analysis and predictions also about market, infrastructure, battery capacity and electricity required.

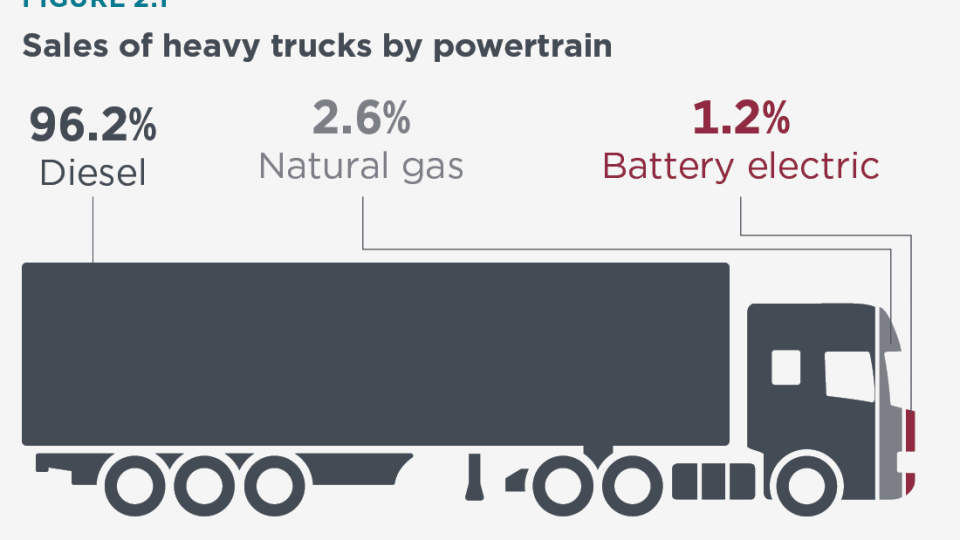

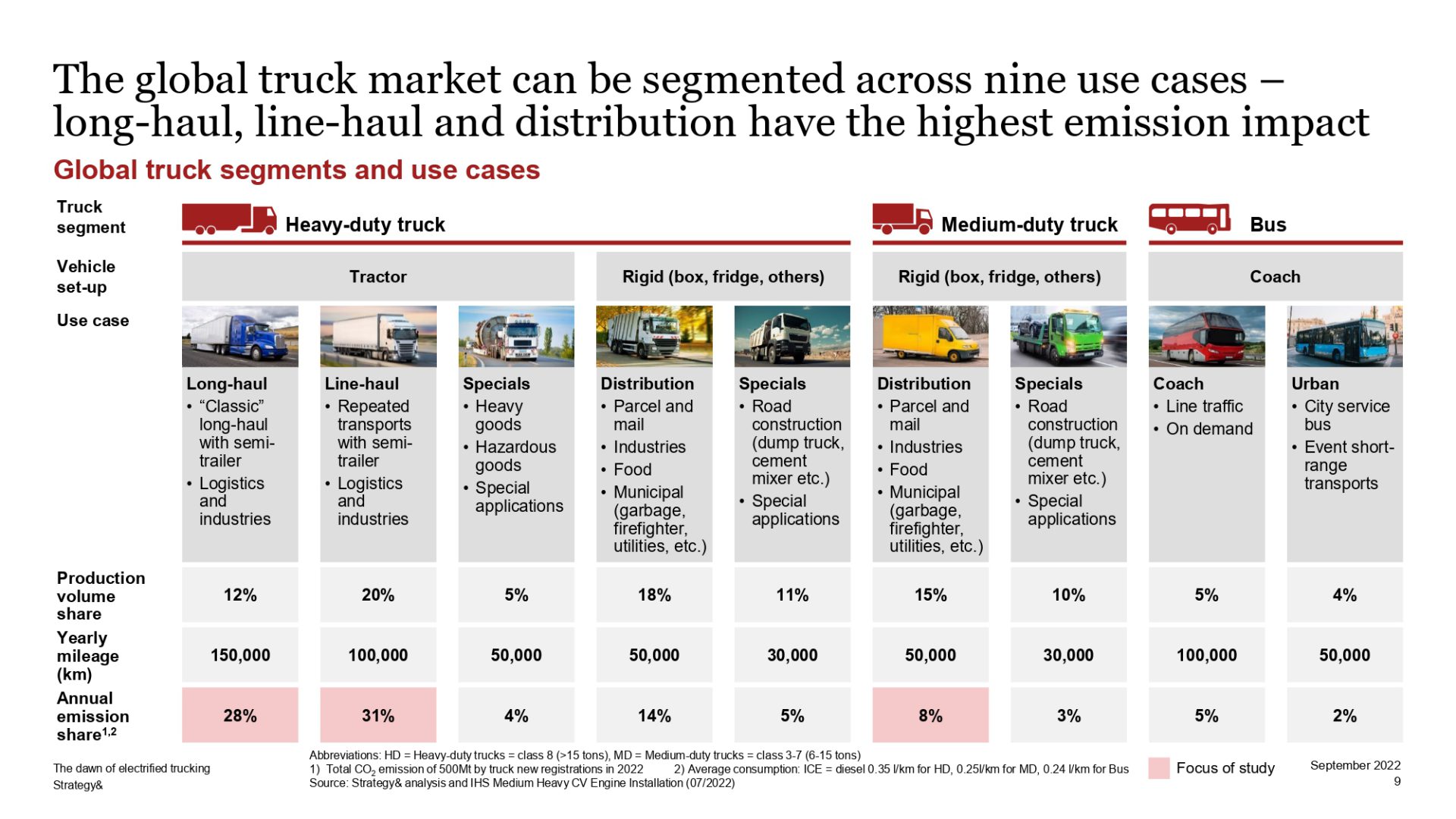

The Truck Study 2022 released by global player PwC contains some extremely relevant facts, trends and prediction for the future of transport, and mainly for the future of goods transport. Although it’s not easy to summarize what the study says, we triedy to take stock of the main points. Generally speaking, battery electric and fuel cell trucks seem to have quite a bright future ahead, with predictions to account for 30% of the overall sales in 2030, with “dominance” in the main global areas (North America, the EU and Greater China) in 2035, accounting for 80% of the overall sales.

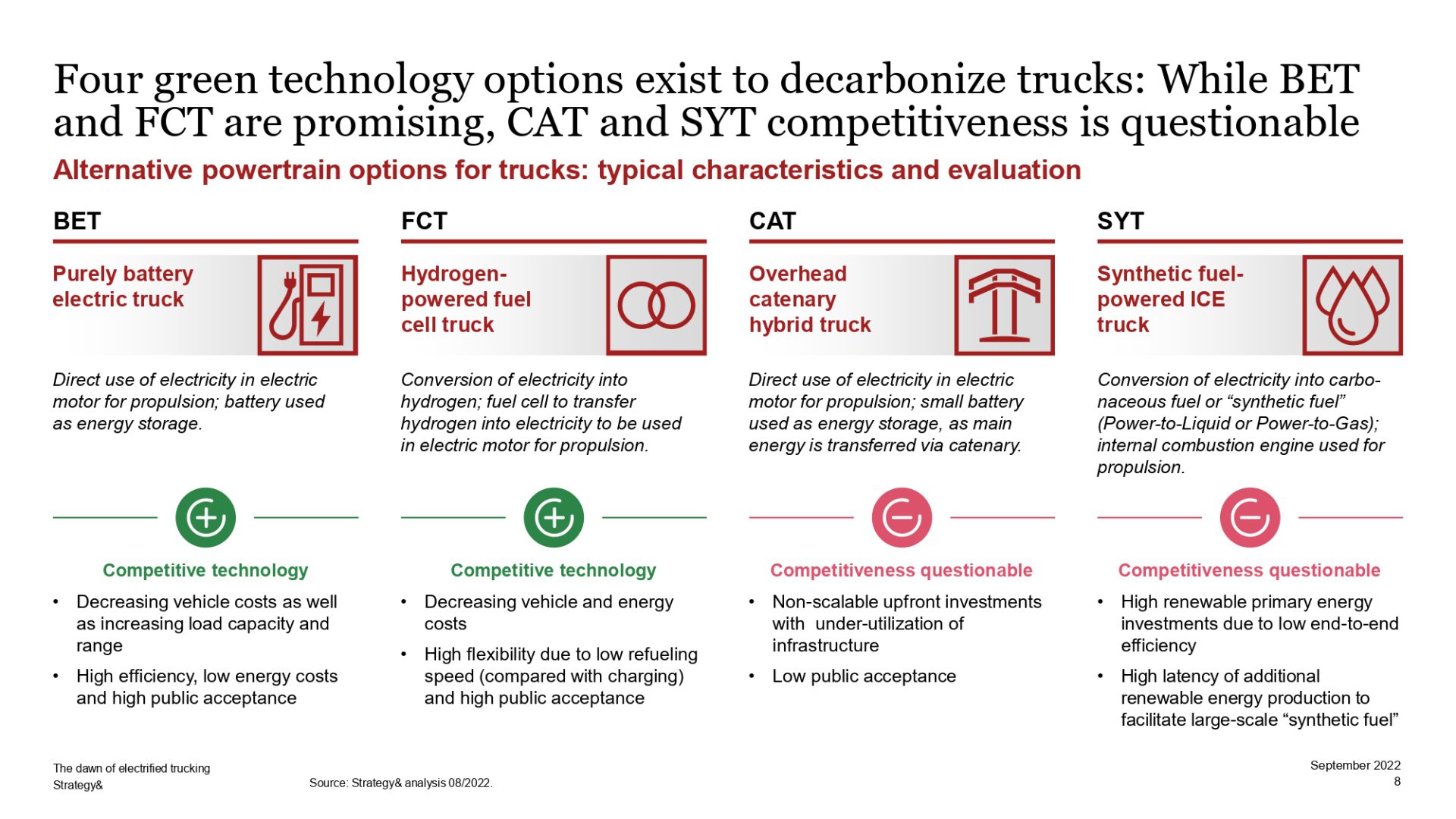

In Europe, for instance, stricter emissions regulations, green funding and energy autarchy are the main drivers pushing towards electrification. Regulators are “currently discussing tighter CO2 emissions targets to 45% to 60% in 2030. Talking about technology, battery electric and fuel cell trucks have higher competitiveness levels compared to other technologies, such as catenary hybrid trucks or synthetic fuel-powered ICE trucks, for instance (pic below), due to a better TCO in the medium-to long-term. In terms of costs, according to PwC, “alternative powertrains translate into additional vehicle costs of approximately €90,000” for long-haul trucks. This gap is expected to significantly reduce by 2035.

PwC Truck Study 2022: charging infrastructure needed

Of course, PwC recalls the urgent need for public truck charging infrastructure, with investments up to €1 billion to set up 120 megawatt charging systems by 2025, with different options available to enable alternative powertrain in the various product segments. For the longer term, in Europe, “a high-demand scenario needs 1,800 charging parks (MCS, megawatt charging systems + overnight) and additional 600 pure overnight parks and/or approximately hydrogen refueling stations (HRS) 2,100 stations by 2035 with required investment of up to €15 billion for the MCS network and €21 billion for the HRS network.

In addition, PwC warns about the impact of the charging curve in charging infrastructure planning, especially for very high power levels. It is quite interesting to notice that, during ramp-up of new infrastructure for heavy-duty trucks MCS “requires similar investments to FCT to enable initial cross-European trips”. However, the investment in the supply infrastructure “is only a small share compared with the cost to produce the extra electricity required”.

Predictions on TCO

Let’s have a look at TCO, the actual key to predict the future of zero emissions commercial vehicles. To summarize the results of the study, battery electric trucks (BET) “outperform ICE technology from 2025 onwards in most use cases in terms of total cost of ownership, reaching a cost advantage of 26-34% in 2030″. Fuel cell trucks (FCT) achieves TCO competitiveness versus ICE starting from 2030. Energy costs are identified as the main TCO driver, even though the electricity price corridor is mainly driven by “political-economic factors, energy demand size and infrastructure mark-up”.

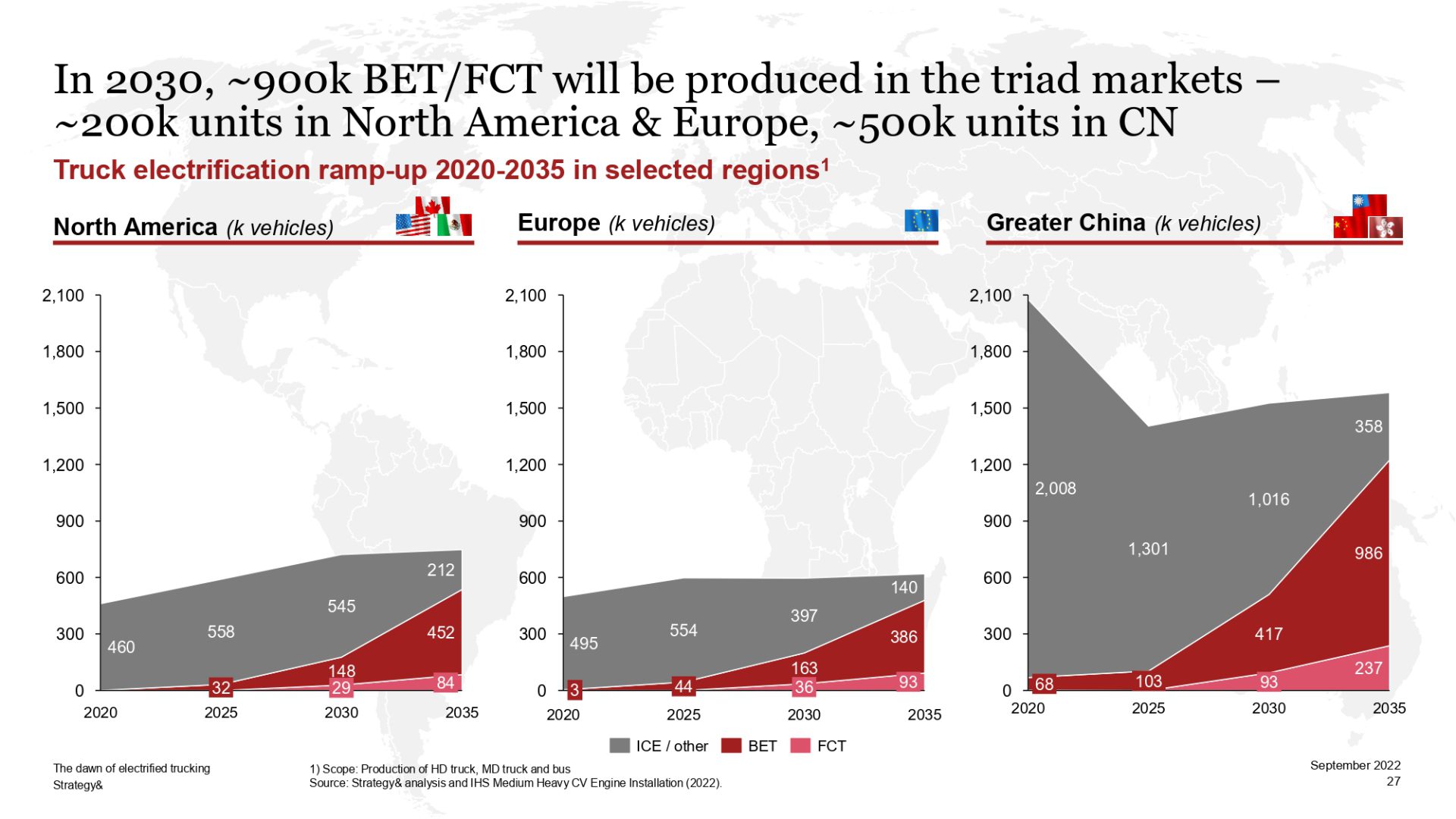

Finally, here’s how PwC thinks the CV market will be in the next future. In 2030, the expectation is to have about 900,000 BET/FCT produced in the aforementioned markets, which translates into about 200,000 units in North America and Europe respectively, and 500,000 units in Greater China. Increasing ZEV diffusion and battery capacities result in a significant truck battery demand of about 170 GWh in

Europe by 2035, over 800 GWh in the triad markets.