The latest ICCT study on TCO in freight transportation: BEVs and FCEVs the only viable alternative to diesel trucks

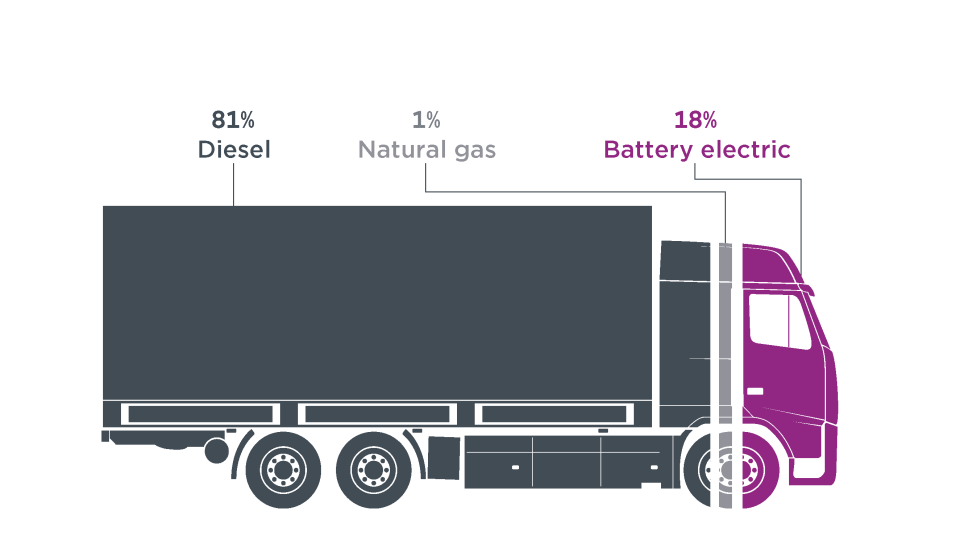

Battery electric and hydrogen fuel-cell trucks, hydrogen internal combustion engine trucks, and conventional trucks powered by alternative fuels are the truck technologies and fuels identified by the ICCT as concrete alternative options to the current diesel standard. The TCO includes the costs of truck acquisition, European-average fuel prices, maintenance, and European-average road tolls, taxes, and levies.

The international organization ICCT has published quite an interesting and thorough analysis on the evolution of TCO (Total cost of ownership) in freight transportation. “Analyzing the economic competitiveness of truck decarbonization pathways in Europe”, is the title of the research, whose full final document can be browsed (and downloaded) here.

Battery electric and hydrogen fuel-cell trucks, hydrogen internal combustion engine trucks, and conventional trucks powered by alternative fuels are the truck technologies and fuels identified by the ICCT as concrete alternative options to the current diesel standard. The TCO analysis in the paper made available a few days ago covers several HDV segments, including tractor trailers operating in long-haul with gross vehicle weight (GVW) reaching 40 tonnes, rigid trucks operating in regional delivery and urban delivery, and light-duty trucks operating in urban delivery.

ICCT and the study on TCO for the trucks of the future

These HDV segments were chosen to ensure comprehensive coverage of the different HDV applications in Europe while focusing on the segments with the highest sales shares. The TCO includes the costs of truck acquisition, European-average fuel prices, maintenance, and European-average road tolls, taxes, and levies.

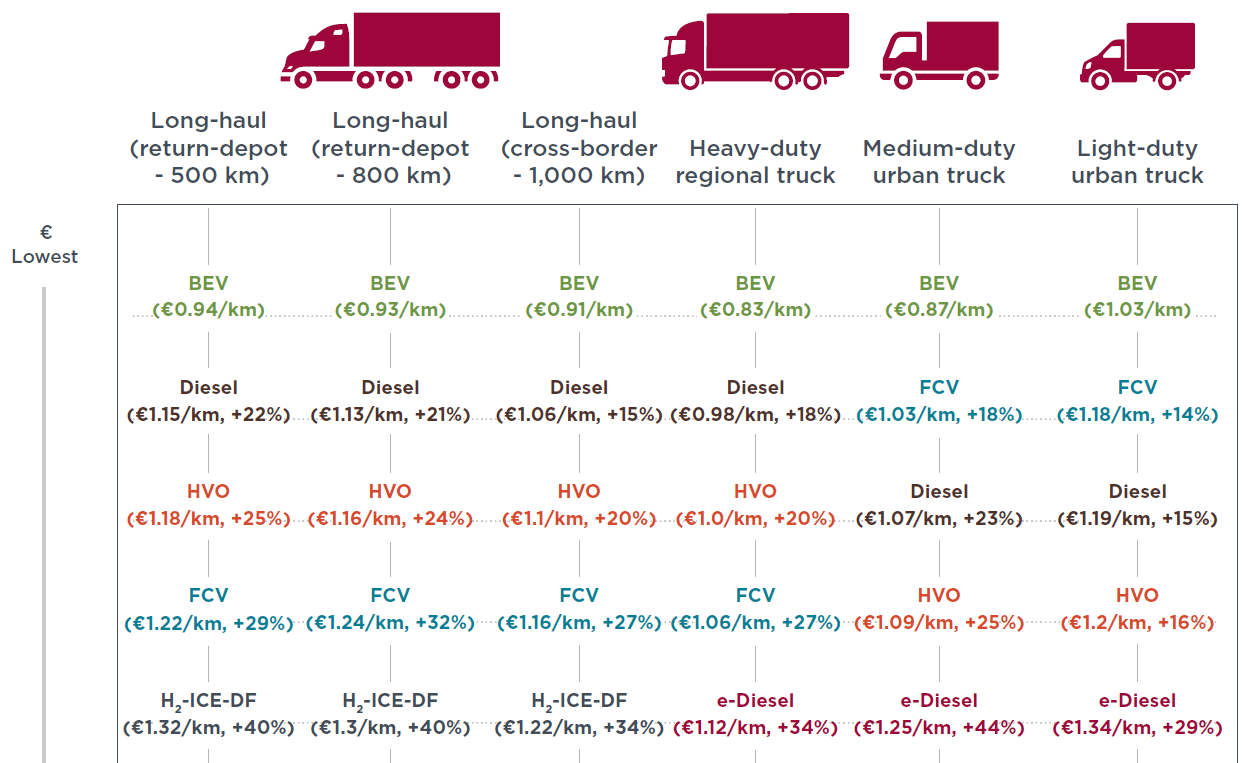

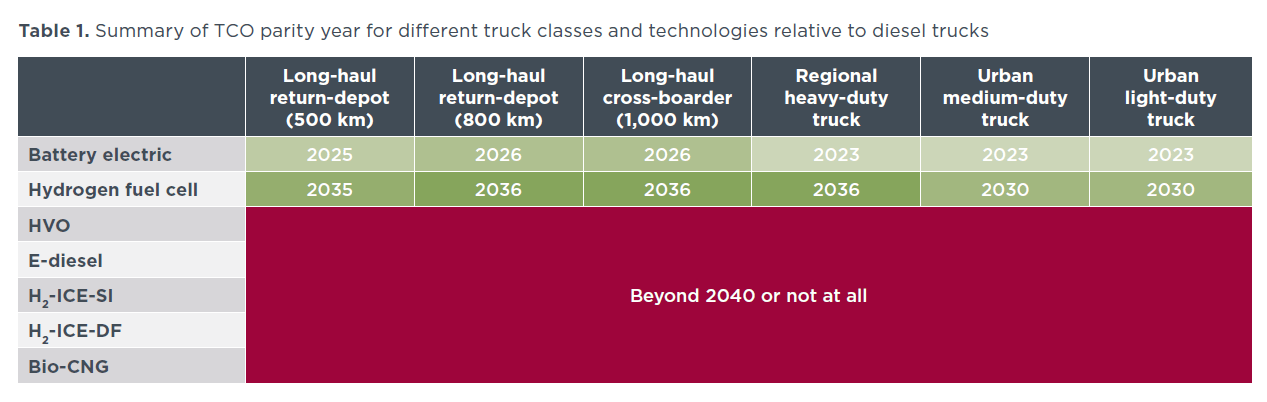

In short, what emerged from the analysis conducted by Hussein Basma and Felipe Rodriguez is that BEVs seem to be the least-cost decarbonization pathway for most truck classes before 2030. While medium- and light-duty urban battery electric trucks are already at TCO parity with their diesel counterparts, for heavy-duty long-haul trucks, TCO parity with diesel is expected to be achieved between 2025 and 2026 due to the more expensive upfront costs driven by the large batteries needed.

On the other hand, fuel cell trucks powered by green hydrogen are expected to become cost competitive with diesel trucks by 2035. More into details, fuel-cell trucks will reach TCO parity with diesel trucks by 2030 for medium- and light-duty urban trucks and by 2035 for trucks operating in the long haul. In the long term, fuel-cell trucks will record a 10% to 20% higher TCO than battery electric trucks.

Keeping more or less the same powertrain structure, conventional trucks powered by alternative low-GHG fuels such as HVO, e-diesel, and bio-CNG will struggle to match the economic performance of diesel trucks and will record a 15% to 45% higher TCO than their zero-emission counterparts by 2030.

This is mainly due to a combination of high fuel costs and low vehicle energy efficiency. So, trucks running on e-diesel or bio-CNG are expected to record the highest TCO among all considered decarbonization pathways and across all truck classes. Trucks running on 100% HVO will record a better TCO than those powered by e-diesel and bio-CNG, but they would still be 20% to 30% more expensive than battery electric trucks.

The scenario of hydrogen-powered internal combustion engines

Finally, trucks employing hydrogen ICEs won’t be able to match the economic performance of their zero-emission or diesel counterparts. However, they are expected to record a better TCO than conventional trucks powered by e-diesel and bio-CNG in the long term. Driven by the price of green hydrogen fuel and the higher fuel consumption relative to zero-emission trucks, hydrogen combustion powertrains are expected to be 25%–45% more expensive than battery-electric trucks by 2040. However, the technology’s economic performance can overcome that of conventional trucks powered by e-diesel and bio-CNG, recording up to 15% lower TCO for long-haul trucks.