China, new energy commercial vehicle registrations keep growing

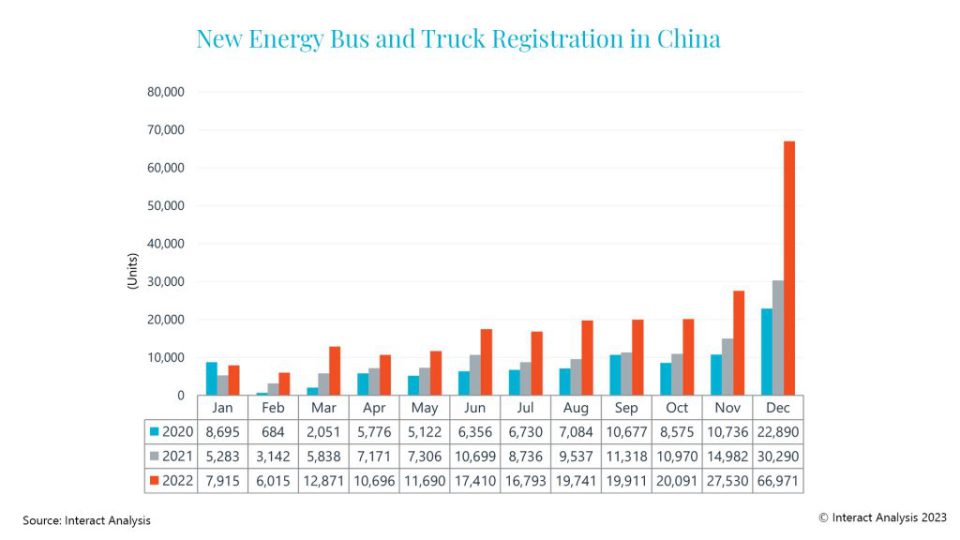

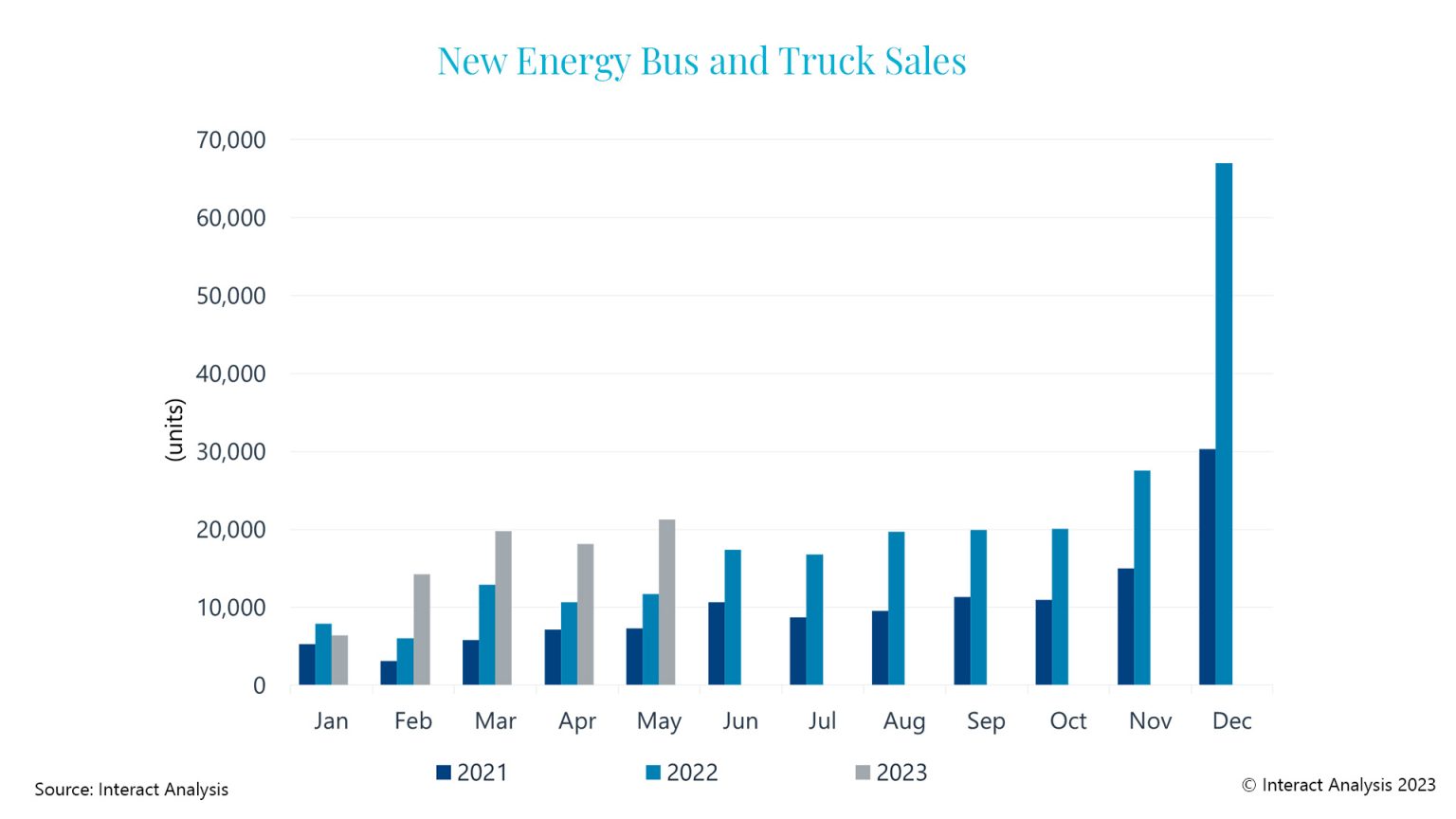

According to Interact Analysis' Research Associate, Yvonne Zhang, about 21,308 buses and trucks with BEV, FCEV or hybrid powertrains were registered in May, 82% more compared to May 2022 and 17% higher compared to the previous month. An in-depth analysis.

New energy commercial vehicle registrations keep growing in China. Indeed, according to Interact Analysis’ Research Associate, Yvonne Zhang, about 21,308 buses and trucks with BEV, FCEV or hybrid powertrains were registered in May, 82% more compared to May 2022 and 17% higher compared to the previous month. The penetration rate of new energy commercial vehicles in China has reached 8.9% in May from 5.3% for the same month last year.

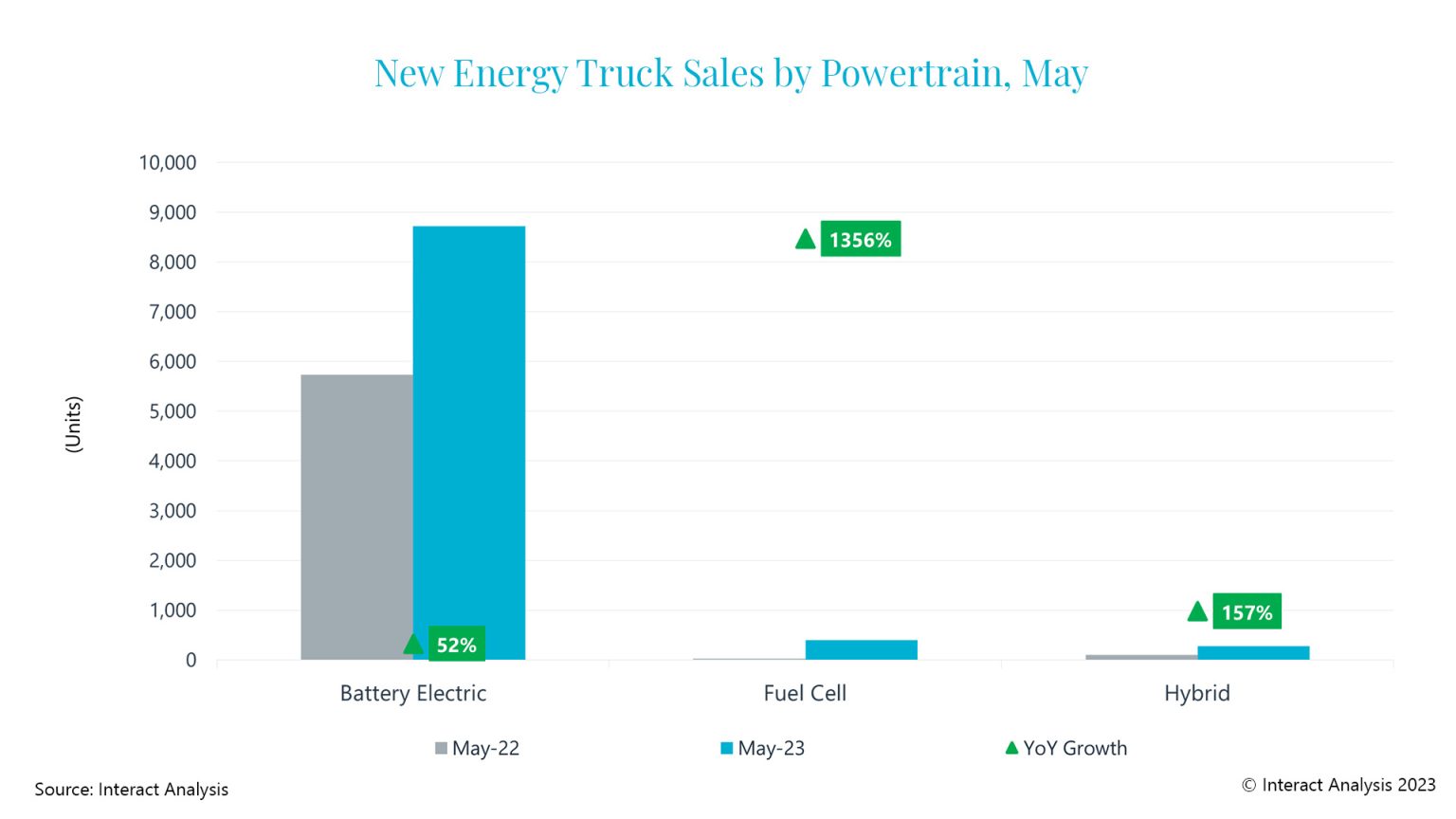

More into details, in May, total sales of new energy light commercial vehicles exceeded 17,000 units, a year-on-year increase of 133%, accounting for 82% of overall sales of new energy commercial vehicles. Meanwhile, sales of new energy heavy-duty commercial vehicles reached over 2,537 units, down by 22% year-on-year. This decline was mainly attributable to a drop in sales of large buses. Sales of new energy light-duty trucks reached 6,733 units over the month with a year-on-year growth rate of 72%, accounting for 72% of the new energy truck market and mainly consisting of battery electric logistics vehicles.

New energy vehicles: the current trends in China

According to the China New Energy Bus and Truck Market Tracker by Interact Analysis, heavy-duty trucks have a GVW of over 14 tons, medium-duty trucks have GVW between 6 and 14 tons, while light commercial vehicles have GVW lower than 6 tons (with mini trucks referred to vehicles with GVW lower than 1.8 ton).

It’s quite interesting to notice that fuel cell commercial vehicles had the fastest growth rate. Registration sales of fuel cell commercial vehicles reached 517 units in May, a year-on-year increase of over 8 times and a month-on-month increase of 19%.

Potrebbe interessarti

China, zero emission trucks and buses grew at the end of 2022. Interact Analysis’ forecasts for 2023

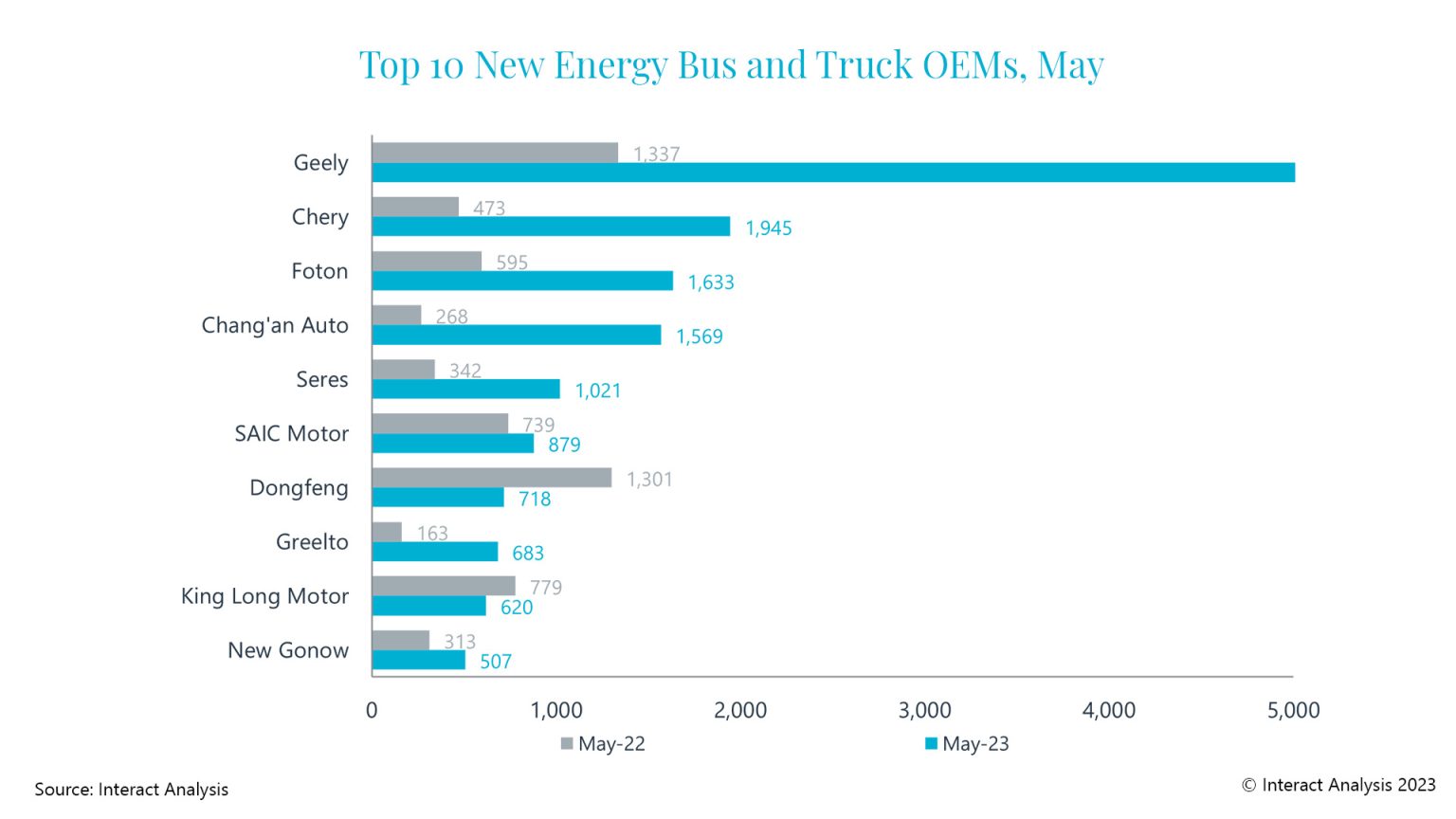

Finally, in May, the top three OEMs for new energy commercial vehicles remained unchanged from the previous month. Geely has been in first place for 13th consecutive months, with a market share of 29% in May. With the exception of King Long Motor, which focuses on large-sized buses, the sales of other top ten OEMs mainly focus on the sale of light-duty bus and trucks, with seven of them having a market share of over 90% in the light-duty vehicle segments. SAIC Motor, Greelto, and New Gonow re-entered the top ten list, while SANY, Zhengzhou Yutong, and JAC dropped out of the top ten rankings.