Electric vehicle production is not an easy game: how giants and startups are facing the challenges

Among nervous investors and battery manufacturers cutting their profit forecasts, start-ups are sinking. Tesla burned 70 billion dollars in a day. The Semi, though, keeps being a candidate to carve out a place for itself, unlike start-ups. Volta Trucks went into bankruptcy, dragged down by Proterra’s collapse, massive cuts for Arrival.

As shown by Steve Jobs, who raised Apple from its own ashes, often “a good presentation is worth more than what you sell”. It’s no coincidence that he was known to put obsessive care in preparing every public speech, rehearsing it over and over again for days. An example that Elon Musk seems to have ignored, at least upon presenting Tesla’s latest quarterly report to shareholders. It’s hard to say whether it was his bad choice of words as he said “we dug our own grave with the Cybertruck” or the clumsy analysis of the 11% decline in revenue for unit sold from 2022 following the price war waged against Chinese manufacturers. One thing’s for sure: that the American car builder’s shares burnt 70 billion dollars’ worth of stock market capitalisation in a day, plus some 20 billion from Musk’s own capital.

The case of Tesla cybertruck in electric vehicle design and production

A “mini disaster” according to Wall Street analysts, that triggered a downward revision of forecasts among Tesla’s suppliers. Indeed, both Panasonic and LG have drastically revised their profit forecasts for 2023; while the Japanese have grounded their production cuts in reasons linked to “stock rotation”, LG Energy Solution Chief Financial Officer Lee Chang Sil told the Financial Times that the Polish plant’s slowdown was due to the fact that “EV demand might be lower than expected: the high interest rates are stifling consumer expenditure in the USA and growth is slowing in Europe”. Like icing on a cake comes Toyota’s announcement of an 8 billion investment to increase the number of production lines from 2 to 10 in their North Carolina production facility, building batteries for their own hybrid and plug-in hybrid systems. File that under : “Battery cars: anyone seriously believing in them?”

Doubts keeps growing on the Cybertruck, Tesla’s take on the pretty much star-striped world of pick-up trucks. Musk has long been heralding its arrival, but leaving aside its space-age design, an empty weight of six to seven thousand pounds (2.720-3.175 kg) risks making it unpalatable to the American market, which is, indeed, also snubbing its competitor – the 6800-pound Ford F-150 Lightning. And what Elon said about the Cybertruck reminded many investors of Ford admitting having burnt some 36,000 dollars- such is the amount they lost – for each EV they sold in 2023.

Also, it should not be forgotten that the Cybertruck may end up being impossible to sell in many markets, such as Europe, where its weight in excess of 3500 kg it would require a truck-driving licence.

If for cars the forecasts call for storm in the stock market, what made the alarm bell go off in the commercial vehicle sector – seemingly in contrast to the data on vehicle registration provided by the European Automobile Manufacturers’ Association for the first three quarters of 2023- is the downward trend of the numerous startups that followed into Elon Musk’s footsteps in the heavy load industry.

Electric commercial vehicles: some key figures

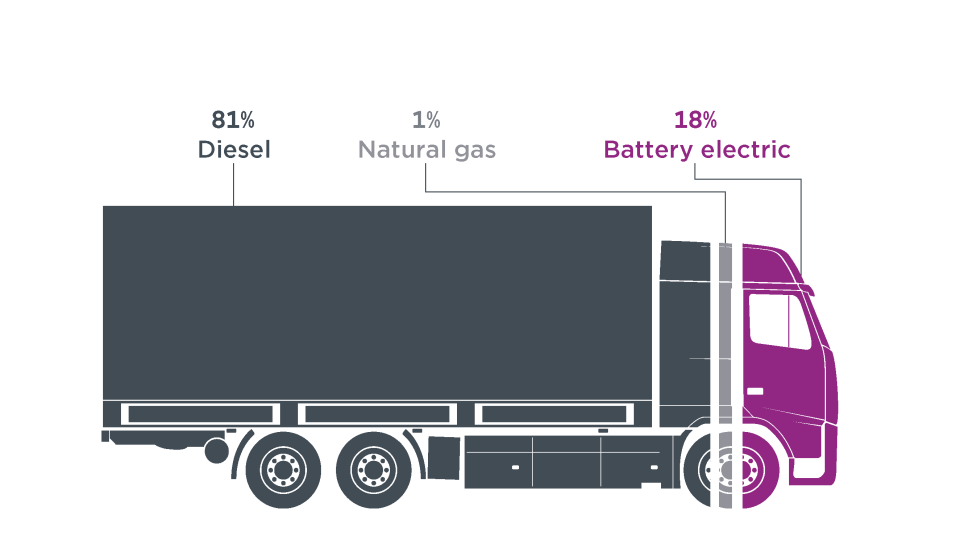

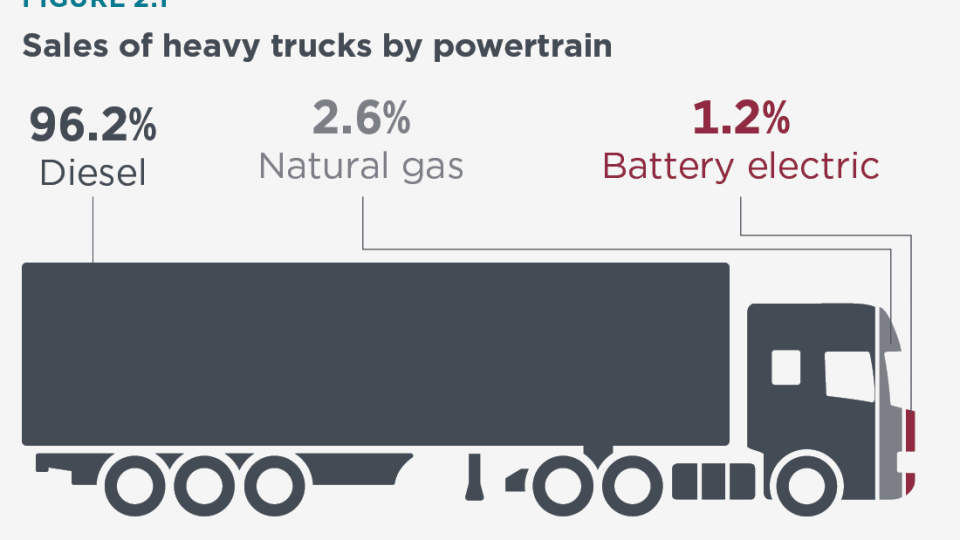

For those who are content with percentage increases, a + 423% for the range between 3.5 and 16 tons and a + 236% for the heavy segment will be more than enough. But the disappointment comes with absolute numbers: 2228 registrations out of the 41,032 totalled in the medium range, and 1690 out of a total of 227,734 in the top class sure can’t be called a miracle. Not to mention light vans, accounting for less than 80 thousand plates registered out of over a million vehicles hitting the road. Speaking of the top class, the divorce between Iveco and Nikola showed that in the heavy load world there isn’t much room for new entries, with the exception of the Class 8 tractor USA developed by Tesla.

A futuristic vehicle, the Semi, with a driving range that few really managed to see first-hand, and, above all, production numbers that are vague, to say the least, when moving beyond the test vehicles entrusted to operators.

As for the others, Iveco has to carry on with the work done with Nikola and announced their own battery and fuel cell vehicles; others like Volvo, Scania, Daf and Mercedes already have battery electric heavy vehicles in their product offer, with a driving range usually between 400 and 500 km, the typical mileage covered in a driving shift on the odometer.

Apart from production costs, given the scarcity of charging stations for trucks in Europe, there are still some rough edges to be smoothed out concerning the difficult balance between payload and driving range. Yet the three planets – production costs, payload and driving range – struggle to align, as shown by the startups’ very bad year in the medium weight segment.

The default of Swedish Volta Trucks – that could count on 300 million racked from investors, a list of orders totalling 5000 vehicles and DB Schenker among its clients with 6500 units – made big news, but there’s an impressive list of new manufacturers that have filed for bankruptcy over the last 24 months. It’s true – as pointed out by Reuters’ analysts – that putting a new LCV on the market can cost up to a billion dollar, but a look to 2021 news headlines is enough to realize that top players like British Arrival and USA-based Lordstown Motors Corp and ELMS Elecric Last Mile Solution are by now long forgotten. As for Canoo, winner of the Best Concept Award 2021, they presented their Elettra LDV190 van last August, but they’re still stuck with the pre-series despite having been optioned by trade giant Walmart.

The only top-scoring LCV for distribution is Rivian’s EDV, the delivery van coming in three sizes (500-700-900) developed for Amazon. Indeed, the EDV 700 fleet in operation has crossed the psychological threshold of 10 thousand units and the massive order for 100,000 units to be delivered by 2030 allows the USA brand to look to the future with relative peace of mind.

Other valuable players are approaching a challenging market

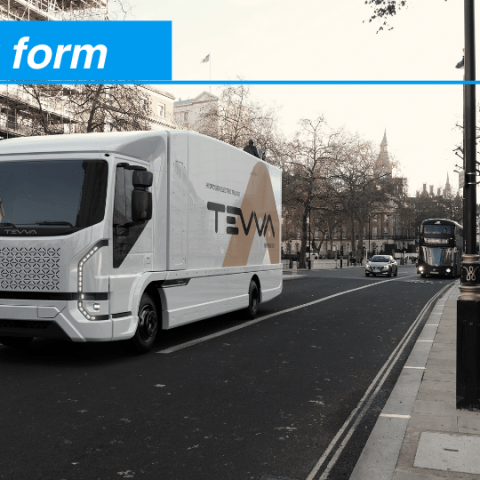

For Israeli Ree Automotive and their chassis P7-C problems stretch way beyond production issues into the realm of international politics. The last months of 2023 – the first delivery deadline – will, instead, show the concreteness of British Tevva’s project of a 7.5 ton battery electric truck and hydrogen fuel cell range extender. Tevva’s goal – one they already missed – was to manufacture 10 thousand units by the end of the year; but the prospects of a 250 km driving range – growing by a further 500 with the range extender – allowed the startup based in Tilbury, Essex, to stay afloat.

The future’s a bit more uncertain for the recent Lego-like modular minivan, as well as for the van with Tesla-style chassis-incorporated batteries proposed under the name of eCV1 by Watt Electric Vehicle Company, another British startup.

The killer application, though, may come from China, backed by titan Geely, one of Beijing’s four big companies: still a prototype for the time being, the 3.5 ton SuperVan with the FarizonAuto brand scheduled for 2024 is a commercial van belonging to the New Energy Vehicle family, equipped with an interchangeable battery, cruise control and smart navigator to plan and manage recharging, in addition to a methanol range extender capable of doubling the conventional driving range. One last detail, the body is separate from the chassis, and in combination with the “drive by wire” driving system it allows for endless possibilities as to wheelbase and body building. If it gets to be produced, it could really smash the ambitions of many competing innovators that are more rich in ideas than in experience and capital.